In response to the international community’s growing concern about the problem of money laundering and potential terrorist financing, many countries around the world are enacting or strengthening their laws and regulations regarding this subject.

Anti Money Laundering Act, 2002 was passed by Indian Parliament in the year 2002 and the Act became effective from 1st July, 2005.

The Act specifies statutory duties for Banking companies, Financial Institutions and Intermediaries. The compliance with these duties is intended to supplement the law enforcement authorities activities, to detect proceeds derived from serious crimes and help to effectively prevent money laundering, terrorist financing, and recycling of illegally obtained money.

The purpose of this policy is to establish the general framework for the fight against money laundering, terrorism, financial crimes and corruption.

Reliance Securities is committed to examining its Anti - Money Laundering strategies, goals and objectives on an ongoing basis and maintaining an effective Anti - Money Laundering program for its business that reflects the best practices for a diversified, retail financial services firm.

GLOBAL FRAMEWORK

In response to mounting concern over money laundering world wide the G-7 Summit held in Paris in 1989 established a policy making body, having secretariat at Organisation for Economic Co-operation and Development (OECD), which works to generate the necessary political will to bring about national legislative and regulatory reforms to combat money laundering and terrorist financing.

The World Bank and the IMF have also established a collaborative framework with the FATF for conducting comprehensive AML/CFT assessments of countries’ compliance with the FATF 40+8 Recommendations, using a single global methodology.

India has been accorded ‘Observer’ status

OECD Fast Facts:

Established: 1961 Membership: 30 countries Budget: EUR 303 million (‘09) Secretariat staff: 2500 Publications:250 new titles/yr

INDIAN FRAMEWORK

The Prevention of Money Laundering Act, 2002 came into effect from 1st July 2005

Necessary notifications/ rules under the said Act were published in the Gazette of India on 1st July 2005 by the Dept of Revenue, Ministry of Finance, Government of India

Subsequently, SEBI issued necessary guidelines vide circular no. ISD/CIR/RR/AML/1/06 dated 18th January 2006 to all securities market intermediaries registered under section 12 of the SEBI Act, 1992

Guidelines were issued in the context of recommendations made by the Financial Action Task Force (FATF) on anti-money laundering standards.

SEBI issued master circular ISD/AML/Cir-1/2008 on December 19,2008 consolidating all the requirements/ obligations issued with regard to AML/ CFT till December 15, 2008

- Banking company

- Financial institution

- Intermediary (which includes a stock broker, sub-broker, share transfer agent, portfolio manager, other intermediaries associated with securities market and registered under section 12 of the SEBI Act,1992)

shall have to maintain a record of all the transactions; the nature and value of which has been prescribed in the Rules under the PMLA. Such transactions include:

- All cash transactions > Rs 10 lacs or its equivalent in foreign currency.

- All integrally connected series of cash transactions < Rs 10 lacs or its equivalent in foreign currency within one calendar month.

- All suspicious transactions

Money Laundering involves disguising financial assets so that they can be used without detection of the illegal activity that produced them.

Through money laundering, the launderer transforms the monetary proceeds derived from criminal activity into funds with an apparent legal source.

Money laundering is the process by which criminals attempt to hide and disguise the true origin and ownership of the proceeds of their criminal activities.

The term “Money Laundering” is also used in relation to the financing of terrorist activity (where the funds may, or may not, originate from crime).

Money Laundering is a process of making dirty money look clean.

Money is moved around the financial system again and again in such manner that its origin gets hidden.

It has become more evident that the next generation of identity thieves will deploy sophisticated fraud automation tools

The increased integration of the world's financial systems and the removal of barriers to the free movement of capital have enhanced the ease with which criminal money can be laundered

Every year, huge amounts of funds are generated from illegal activities. These funds are mostly in the form of cash

The criminals who generate these funds try to bring them into the legitimate financial system

Over $1.5 trillion of illegal funds are laundered each year

Successful money laundering activity spawning yet more crime, exists at a scale that can and does have a distorting and disruptive effect on economies, marketplaces, the integrity of jurisdictions, market forces, democracies etc.

Finances Terrorism: Money laundering provides terrorists with funds to carry out their activities

Undermines rule of law and governance: Rule of Law is a precondition for economic development – Clear and certain rules applicable for all

Affects macro economy: Money launderers put money into unproductive assets to avoid detection.

Affects the integrity of the financial system: Financial system advancing criminal purposes undermines the function and integrity of the financial system

Reduces Revenue and Control: Money laundering diminishes government tax revenue and weakens government control over the economy

Suspicious Transaction means a transaction whether or not made in cash which, to a person acting in good faith:

- Gives rise to a reasonable ground of suspicion that it may involve the proceeds of crime

- Appears to be made in circumstances of unusual or unjustified complexity

- Appears to have no economic rationale or bonafide purpose

- Gives rise to a reasonable ground of suspicion that it may involve financing of the activities relating to terrorism

- Identity verification or address details seems difficult or found to be forged / false

- Asset management services where the source of the funds is not clear or not in keeping with apparent standing /business activity

- Substantial increases in business without apparent cause

- Unusual & Unexplained large value of transaction

- Transfer of large sums of money to or from overseas locations

- Unusual & Unexplained activity in dormant accounts

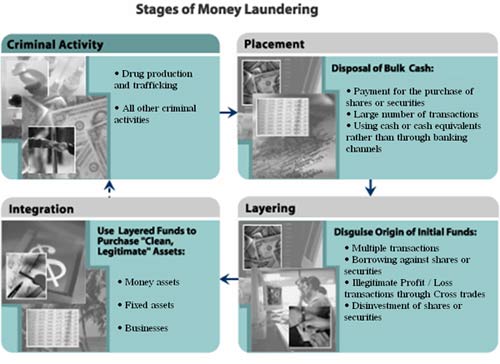

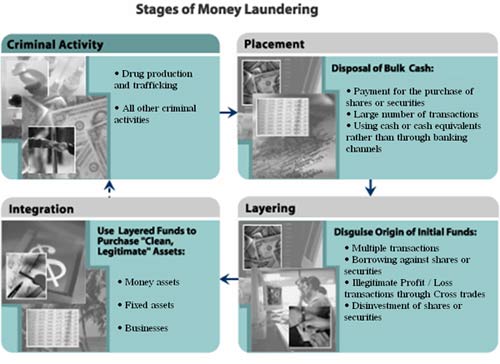

Although money laundering is a complex process, it generally follows three stages:

- Placement is the initial stage in which money from criminal activities is placed in financial institutions. One of the most common methods of placement is structuring—breaking up currency transactions into portions that fall below the reporting threshold for the specific purpose of avoiding reporting or recordkeeping requirements.

- Layering is the process of conducting a complex series of financial transactions, with the purpose of hiding the origin of money from criminal activity and hindering any attempt to trace the funds. This stage can consist of multiple securities trades, purchases of financial products such as life insurance or annuities, cash transfers, currency exchanges, or purchases of legitimate businesses.

- Integration is the final stage in the re-injection of the laundered proceeds back into the economy in such a way that they re-enter the financial system as normal business funds. Banks and financial intermediaries are vulnerable from the Money Laundering point of view since criminal proceeds can enter banks in the form of large cash deposits.

Provide complete details at the time of account opening

- Address proof

- Identity proof

- PAN

- Income details

Periodically update of

- Contact details

- Financial details

- Occupational details

The transactions executed need to be commensurate with the disclosed income details

Provide requested Explanation / details for suspicious transactions

A money launderer faces steep fines of twice the amount of the financial transaction, along with forfeiture of assets associated with the laundered funds

Association with a criminal element can severely damage the reputation. It is in the best interests to keep names free of any criminal association

Protect reputation by being informed about anti-money laundering rules and regulations. If anybody sees activity that may indicate money laundering, report it to the Director, FIU India, New Delhi

Whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven or ten years and shall also be liable to fine which may extend to five lacs rupees